Personal Journal: the strategic default of the house we purchased in 2006

Tuesday, May 11, 2010

I'm Not Trendy

Watch CBS News Videos Online

Here is a segment from 60 Minutes. It really just explains more of the same featured in my previous posts. I feel it is pretty balanced, not making the banks look like terrorists, nor the short-sellers like snakes. I find it interesting how the media, and therefor 'the whole world' sees our situation. In a way it is inflammatory. Since I don't have television, it seems amazing that my choices, made independently of news media, is trendy.

I am anything but trendy. I wore/wear hand-me-downs and thrift-store clothing. I sew. I drink tea. I like eggplant, pate', and liver. I don't use a credit card. I don't like ice cream. I like square-toed shoes, and staying on dry land. I'm shy. If it is a trend, I either am a late to the party (facebook, cell phones, tattoos, running), or was doing it before it was trendy (recycling- really that's all on this list).

This week, as we say goodbye to this house that was our home, I don't feel trendy. I don't think something that is hard, is likely to be trendy.

I know that paying a mortgage is hard, because it costs money and time, and sometimes too much money, and too much time. We were faced with the hard choice of doing nothing and living with an unfortunate situation, or being very proactive, and facing the hard task of getting out of a unfortunate situation. As I tape up boxes of our belongings, it doesn't feel like a trend that is newsworthy. CBS can't express the tenderness I'm feeling.

Monday, May 10, 2010

And The Winner Is....

This is me. Clearly. This is a stack of realtor cards. If you have never sold a house, or bought a house, you might not know about this, but every time a realtor shows a house, they leave a card.

I kept a dish by the front door, and if you count, 50 realtors showed our house. 50!!!!! Think about that. Each one brought with them 2-5 potential buyers with them. In three months, we had over 150 house guests? How happy would I be if all of them brought me some nice dark chocolate, and laid it in the dish, instead of card stock?

Did I clean my house to perfection? You bet I did. Did I need to? Absolutely not, but I wanted to. Now, my house is 70% in boxes, and it is hard to tell if it is a mess, or if I am moving. It is probably both. This morning after I got the kids out the door, I took a nap! After this, I'm putting all my fabric into clear plastic bins, so I can see in, and get organized! After that? I might fill a box with kid-closet stuff. This is not the glamourous part of a short-sale, and come to think of it, none of it is too appealing. I know cable TV shows try to make getting organized, home sales, and yard work alluring, but still it is just dusty, dirt and hard work.

The top card is the realtor who's clients are buying our house.

I kept a dish by the front door, and if you count, 50 realtors showed our house. 50!!!!! Think about that. Each one brought with them 2-5 potential buyers with them. In three months, we had over 150 house guests? How happy would I be if all of them brought me some nice dark chocolate, and laid it in the dish, instead of card stock?

Did I clean my house to perfection? You bet I did. Did I need to? Absolutely not, but I wanted to. Now, my house is 70% in boxes, and it is hard to tell if it is a mess, or if I am moving. It is probably both. This morning after I got the kids out the door, I took a nap! After this, I'm putting all my fabric into clear plastic bins, so I can see in, and get organized! After that? I might fill a box with kid-closet stuff. This is not the glamourous part of a short-sale, and come to think of it, none of it is too appealing. I know cable TV shows try to make getting organized, home sales, and yard work alluring, but still it is just dusty, dirt and hard work.

The top card is the realtor who's clients are buying our house.

Thursday, May 6, 2010

Dump Run

At this point the ethics, principles, and possibilities in regards to our underwater mortgage have been reduced to this: elbow grease.

Also, in other news, we do not have a place to live, unless we move in with the folks. We do have 3 whole weeks to procure housing for ourselves, our children, two dogs, ferrel cat, and broken-down VW Vanagon. I'm feeling the heat, from the busy end-of-school activities, including overnight camping trips, quilt making, 2 plays, gymnastics practice, dentist appointments, rental acquisition, box-packing, and then just stuff like breathing.

Also, in other news, we do not have a place to live, unless we move in with the folks. We do have 3 whole weeks to procure housing for ourselves, our children, two dogs, ferrel cat, and broken-down VW Vanagon. I'm feeling the heat, from the busy end-of-school activities, including overnight camping trips, quilt making, 2 plays, gymnastics practice, dentist appointments, rental acquisition, box-packing, and then just stuff like breathing.

Tuesday, April 27, 2010

I Love Citi!

Subject: BROWN SS APPROVAL 124 DEER PARK

MAKE SURE FULL ARMS LENGTH, FINAL SIGNED HUD AND WIRE CONFIRMATION COME

STRAIGHT TO ME UPON CLOSING TO EMAIL OR FAX 866 421 4408

I know that my frustration with my inability to break through to some sort of resolution personally with Citimortgage might have jaded my former posts. With a lot of help from an experienced realtor, a patient buyer, and a full moon, we received some good news today.

Chatting with an old friend (he was kind), I was struck at how jaded and judgmental I was feeling towards an institution. What a waste of time. Today I am grateful that Citi didn't take its time approving our short sale. We will move by June 4th, unless something changes. Nothing is a sure thing.

It is amazing how one can be lead by her feelings! Today, I feel fine, like I weathered a small storm. Thinking about it, nothing has changed.

Now, to find some boxes, a place to live, and a new plan.

Monday, April 19, 2010

I'm Super Helpful

I have been researching the state of real estate, for this blog, and to squelch my ignorance on the subject. There are so many differing opinions. One day I'm sure that the dire situation of our nation is directly because Silas and Tyson stopped paying our mortgage (your house is worth less because mine is being short-sale-d, the lender won't talk to you cause I'm on hold on the other line, I don't have a hardship, the stock market is down because I have a toxic loan with Citi). Then the next day I'll read something strictly the opposite! Let me explain the latter.

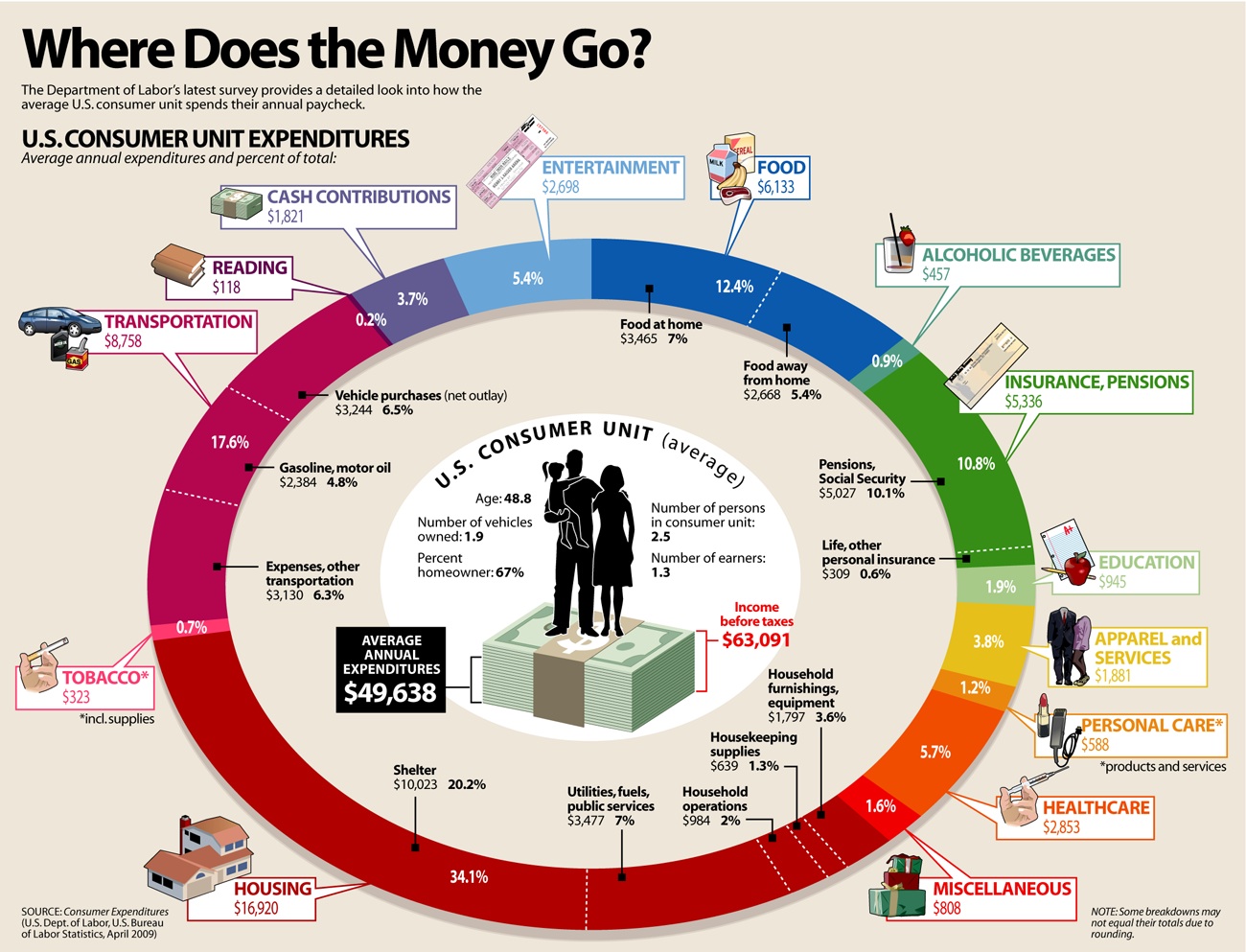

Consumer spending is up. Consumer spending is the driving force of our economy. This is seemingly positive news. You can read that article here. Unemployment is up, savings is at an all-time low, consumer debt is at an all-time high, millions of home owners are in foreclosure, and millions more are delinquent on the mortgage or underwater. Why are more people buying more stuff, if things are getting worse? The claim is that freed-up cash from delinquent mortgage payments are making their way to the cash register.

Consumer spending is a HUGE part of our economy. It actually hurts my head to think that upwards of 72% of our economy is used on buying stuff. Consumer spending is the discretionary money people used on discretionary things. They are: clothing, electronics, recreation, household goods, alcohol. I'll bet you have already figured that we spend the most of any country. This is a chart to see how we rate compared to others. Most people in the world have to spend most of the money they earn on housing, food, and health care. We are fortunate to have the luxury of so much extra. We have made our luxury a driving force for our system of stability. I digress, on to how helpful I really am....

I really like being a helpful and useful person. It is satisfying, and who I am. At the same time, I'll admit I don't buy much stuff. I'm super frugal. Even if I have money, I don't want to spend it, or don't want the stuff you can get with money. I am sure I don't spend 72% of our budget on consumer goods (positive, actually). I'll admit it might even be a problem for me. Sometimes I don't buy something I need, because I am (I'll just say it) cheap. The only exception is if I can spend money on someone else, I'll make an exception for you. Could spending money be useful, or even benevolent?

In the past week I realized that spending money we aren't paying for our mortgage, might free us from 'economy-wrecker-purgatory'.

So far, since we stopped paying our mortgage, I have bought several things. I'm now wondering if I did it because I have some extra money. Did I buy a few extras because I knew it wouldn't impact my budget? I'll list the consumer things I got: 3 new shirts, 1 pair of shorts, pants for my husband, summer sandals for my kids, 4 movie tickets during spring break. I scour for the 75% off stuff (and no, not 75% off at Neiman Marcus) and try to get only what we need (need being relative). Maybe we went out to eat 5 times extra since we stopped paying, but mostly we eat at home. Maybe I got those sandals a month earlier than usual from Ross. Maybe I wouldn't have taken my kids to the 3-D movie.

I guess all I have to say is:

Your Welcome

P.S. Please know that this is in jest. I understand that so many are really suffering from the demise of our economy, real people with children, and bills. I think it is despicable that spending cash on expendables could bolster economic indicators and make us feels as if we are all 'okay'. I still see so many out of work, and living on credit cards, and losing their house. The irony of this is that we feel we are collectively helping, by buying an MP3 player and an extra six pack.

Friday, April 16, 2010

Catching Up

I went out of town for a week, and didn't blog, and tried to think about other things for a bit.

After 3 month on the market so far, and 50 realtor visits, someone made an offer on our house today. Also, foreclosure proceedings should start soon, as we will be 90 days late in a few days. It is a race to see if we can short sale our house, or the bank will foreclose. We are skeptical that we will be able to short sale our house, as we are in no need. The bank will have the final say.

An offer gives us a time line: 90ish days. I hope the folks who made the offer have the patience of Job, and don't mind being disappointed if the bank declines. If they can stand the heat, they will have a value-price dwelling!

I'm excited to think of renting as I am up for a change. A friend even offered me a plot in her garden, so I can still have that! I am trying to have hope and integrity. An offer, or even any sort of movement makes that easier.

The news has been FULL of reports about our situation, and others like us. Here is a clip from a morning show. It is kinda a downer, so think about a cool trip to the zoo when you were a kid after you are done. Let's not take ourselves too seriously.

I don't have TV, but folks are passing stuff my way. Thanks so much!

After 3 month on the market so far, and 50 realtor visits, someone made an offer on our house today. Also, foreclosure proceedings should start soon, as we will be 90 days late in a few days. It is a race to see if we can short sale our house, or the bank will foreclose. We are skeptical that we will be able to short sale our house, as we are in no need. The bank will have the final say.

An offer gives us a time line: 90ish days. I hope the folks who made the offer have the patience of Job, and don't mind being disappointed if the bank declines. If they can stand the heat, they will have a value-price dwelling!

I'm excited to think of renting as I am up for a change. A friend even offered me a plot in her garden, so I can still have that! I am trying to have hope and integrity. An offer, or even any sort of movement makes that easier.

The news has been FULL of reports about our situation, and others like us. Here is a clip from a morning show. It is kinda a downer, so think about a cool trip to the zoo when you were a kid after you are done. Let's not take ourselves too seriously.

I don't have TV, but folks are passing stuff my way. Thanks so much!

Tuesday, April 6, 2010

I Lost on Jeopardy

I have been learning more than I ever thought I would about the world of real estate, lending, and borrowing. As I have previously posted, what I have learned up to this point is nearly nothing, compared to the vast amount of knowledge there is to know.

The other day, my dad was talking about derivatives which is not real estate, but finance. At some point all roads lead to finance, but I'm still confused about how real estate and finance connect (one thing at a time). It is not important to know what derivatives are for this post, because his point is that you can count on one hand the folks who actually know what one is. (Knock yerself out at Wikipedia just to get a taste of the confusion).

I feel as if all the details there are to know about strategically defaulting on a home loan and influencing factors, is like trying to know about derivatives. There are just so many details it is nearly a mystery. I am trying to break it down for myself, because unlike derivatives (I think), this real estate stuff affects me.

So what is the difference between not paying my credit card debt, and not paying for my home loan? This is something that we have had to grapple with, since we pay one, and not the other. Like on Jeopardy, the answer is in the question. One is consumer debt, and the other is real estate.

When I buy dinner out, or a stereo for my car with consumer credit, I've done just that, used something up. I have consumed it. The burrito I ate 9 months ago and paid with credit, as with my stereo, are no longer of value. The credit card company, for a price, will pay for me, until I can pay. They do not care about the burrito after they have paid for it. It does not have any value for me or them. The value for the consumer is that if you want or need something now, you can pay more later. The value for the credit company is that they, for the most part, take money hand-over-fist.

Real Estate is a bit different. It is REAL. When people get a loan for a house, the house itself is collateral. It secures the loan and the signed contract sets the property as being equal to repayment of the loan (well even normally the loan is for 80% of the value of the house.. ensuring the bank can always get its value out of the property). This is why there even exists such an option as foreclosure. It is essentially a legal pathway to resolve the differences between a homeowners willingness/ability to pay, and the banks desire to get paid. With consumer debt the bank "invests" in the individual, in the case of a home loan, the bank shares the risk in the collateral. This is supposed to mean that when the property decreases in value because of the market, the bank should be just as motivated to solve the problem and keep the property afloat as the homeowner is...but because most of us think that we should keep paying out of our desire to be faithful people...the bank can afford to stall.

We have a contract, for my house, with Citi. It is like a triangle, three sides: lender, borrower, structure. If Citi decides they want out of the contract, with my permission, they can give me the house. If I want out of the contract, with permission, I could give them the deed in lieu of payment.

At this point, both Citi, and Tyson have lost money on this house because we have a contract together. These are strange times. It is strange that our home is a "black hole asset". I am not going to pay for an asset, that by all accounts, will never be an investment. I have the ability to give the real thing I am not paying for, to Citi.

I know that even my explanation of the situation is probably up for interpretation, or even wrong. Like I said, I am just learning about something that is exceedingly confusing. A blog is a pretty communal place, so let me know what you think. Set me straight. Let's let Citi worry about what a derivative is.

The other day, my dad was talking about derivatives which is not real estate, but finance. At some point all roads lead to finance, but I'm still confused about how real estate and finance connect (one thing at a time). It is not important to know what derivatives are for this post, because his point is that you can count on one hand the folks who actually know what one is. (Knock yerself out at Wikipedia just to get a taste of the confusion).

I feel as if all the details there are to know about strategically defaulting on a home loan and influencing factors, is like trying to know about derivatives. There are just so many details it is nearly a mystery. I am trying to break it down for myself, because unlike derivatives (I think), this real estate stuff affects me.

So what is the difference between not paying my credit card debt, and not paying for my home loan? This is something that we have had to grapple with, since we pay one, and not the other. Like on Jeopardy, the answer is in the question. One is consumer debt, and the other is real estate.

When I buy dinner out, or a stereo for my car with consumer credit, I've done just that, used something up. I have consumed it. The burrito I ate 9 months ago and paid with credit, as with my stereo, are no longer of value. The credit card company, for a price, will pay for me, until I can pay. They do not care about the burrito after they have paid for it. It does not have any value for me or them. The value for the consumer is that if you want or need something now, you can pay more later. The value for the credit company is that they, for the most part, take money hand-over-fist.

Real Estate is a bit different. It is REAL. When people get a loan for a house, the house itself is collateral. It secures the loan and the signed contract sets the property as being equal to repayment of the loan (well even normally the loan is for 80% of the value of the house.. ensuring the bank can always get its value out of the property). This is why there even exists such an option as foreclosure. It is essentially a legal pathway to resolve the differences between a homeowners willingness/ability to pay, and the banks desire to get paid. With consumer debt the bank "invests" in the individual, in the case of a home loan, the bank shares the risk in the collateral. This is supposed to mean that when the property decreases in value because of the market, the bank should be just as motivated to solve the problem and keep the property afloat as the homeowner is...but because most of us think that we should keep paying out of our desire to be faithful people...the bank can afford to stall.

We have a contract, for my house, with Citi. It is like a triangle, three sides: lender, borrower, structure. If Citi decides they want out of the contract, with my permission, they can give me the house. If I want out of the contract, with permission, I could give them the deed in lieu of payment.

At this point, both Citi, and Tyson have lost money on this house because we have a contract together. These are strange times. It is strange that our home is a "black hole asset". I am not going to pay for an asset, that by all accounts, will never be an investment. I have the ability to give the real thing I am not paying for, to Citi.

I know that even my explanation of the situation is probably up for interpretation, or even wrong. Like I said, I am just learning about something that is exceedingly confusing. A blog is a pretty communal place, so let me know what you think. Set me straight. Let's let Citi worry about what a derivative is.

Subscribe to:

Posts (Atom)